Steaming ahead.

Miura (6005): A leading global industrial boiler manufacturer with 35% recurring revenue trading on a 7% FCF yield.

Initiating my Japan investment newsletter by writing about an industrial boiler manufacturer might seem like an odd move. Using the word “newsletter” means I’ve probably lost the time-poor millennial cohort, and lack of “generative AI” will undoubtedly cost me Gen Z too. What does that leave? Boomers? Boiler enthusiasts? Niche.

What I do hope is that anyone who dares to read this incoherent rambling is a fan of stock markets and interesting investment ideas. Someone who is prepared to look East, as the bulk of the investing community looks West. Someone who likes off the beaten track ideas. If that’s you, I hope you stick around. No generative AI slop here, just good old fashioned human garbage from the mind of yours truly. Walk with me.

Miura, Miura on the wall…

Who’s the fairest of them all? If you’re talking about the industrial boiler market (which I assume you are) then Miura’s definitely up there. Founded in 1959, Miura engages in the manufacture of industrial boilers as well as water treatment (softeners), food processing (vacuum coolers) and medical equipment (steam sterilizers) across 50 countries.

Who needs steam? I hear you ask. Boilers come in handy when brewing beer, processing food, manufacturing textiles and cars and sterilizing hospital equipment, to name a few applications. Satisfied? Onwards.

Miura’s Moats.

Miura’s quality is underpinned by two key elements: leading products and recurring revenue.

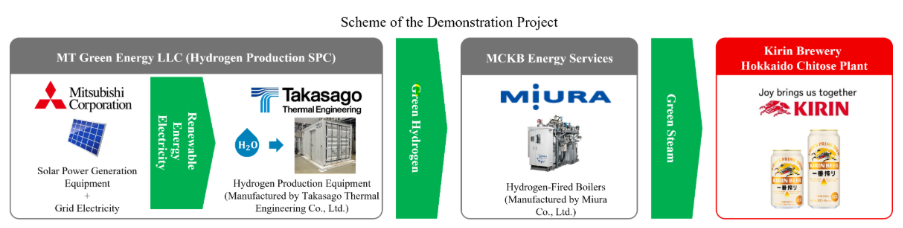

Leading products: In its domestic market of Japan (~50% sales), many of Miura’s products enjoy market leading positions, including 60% share of the domestic once-through boiler market. The group is also leading the charge on the next iteration of products, including the development of more eco-friendly hydrogen boilers. One such current project involves the use of Miura boilers to make more energy efficient beer for leading brewer Kirin. I’ll drink to that.

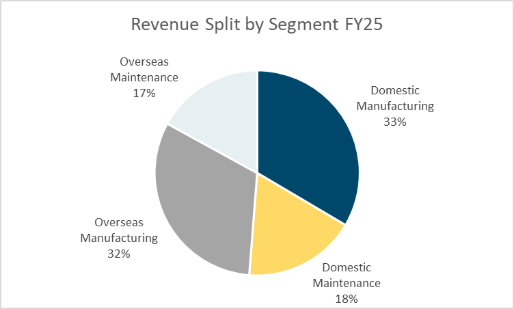

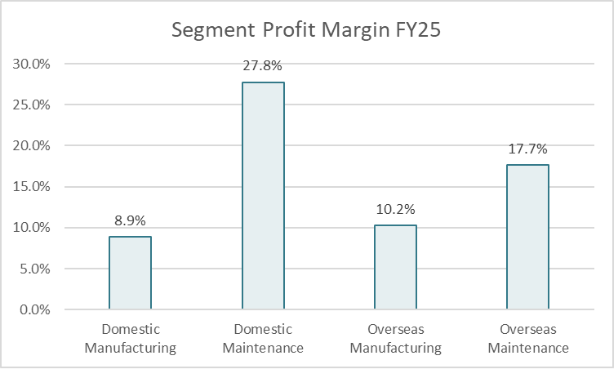

Recurring revenue: Another crucial part of Miura’s model is its maintenance contracts, which account for around 35% of sales. This is recurring, high margin work (shown below), and contract renewal rates are currently running at ~95%. The group is working on closing the gap between domestic and overseas maintenance margins (10ppts!) and are also working on an Internet of Things SaaS offering (“Steam as a Service”) to enhance remote monitoring and predictive maintenance. Yes in 2025 Steam as a Service is a thing.

Why am I writing this rather than being at the pub drinking eco-friendly Kirin beer?

Just bear with me a little longer. Last decade, Miura was the belle of the boiler ball. With high share in its mature and stable domestic market, international growth beaconed, and China became a tantalising prospect. The stock market got ahead of itself on growth assumptions, and when China failed to deliver, the shares let off some steam.

After a brief hiatus, International ambitions resurfaced in 2024 through two acquisitions: CERTUSS in Germany and Cleaver-Brooks (CB) in the US. Japanese corporates have a chequered history with international M&A, so the sizeable $774m Cleaver Brooks deal was likely met with a degree of scepticism by Mr Market. Let’s take a closer look, shall we?

Cleaving through the noise.

The CB acquisition provided a complimentary product set and an enlarged manufacturing presence in the US. Maybe not such a bad thing as corporates attempt to navigate Trump’s Orwellian nightmare.

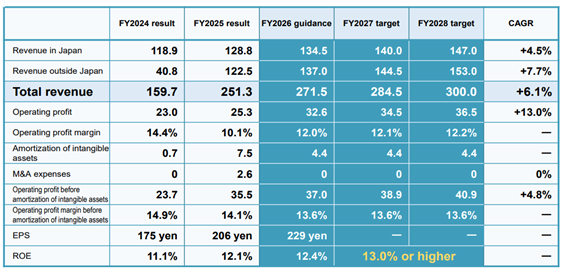

Time for some numbers over narrative. What did all this mean for group financials? At first glance, not much. In the acquisition year, the operating margin got whacked. Not ideal. Delving a little deeper, and underlying profitability [1] was much stronger. Deeper still, and we find the margin compression actually related to the domestic business (cost inflation and mix), not CB.

EBITA – Operating profit adding back amortization of acquired intangible assets and M&A fees. ↩︎

So maybe not so bad after all? A cyclical recovery of the domestic business, combined with CB results which could overshoot (still no synergy targets announced) leaves guidance for 6% sales CAGR and flat margins feeling conservative (just my opinion, happy to debate over a Kirin Ichiban). Adding the possible (long heralded) China resurgence and overseas maintenance margin uplift means I think Miura’s future looks brighter than its past.

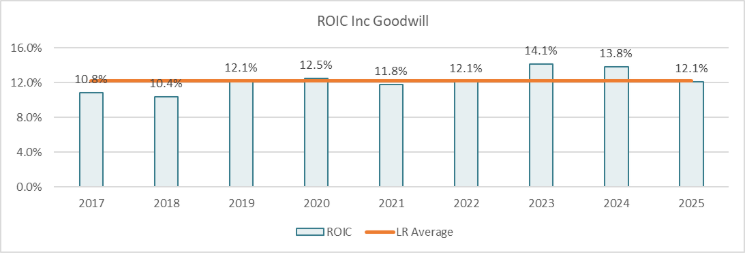

Always being mindful of both sides of the debate, one thing to be aware of is Return on Invested Capital (ROIC) a financial metric that can help assess whether a company is creating value with its investments. This is particularly relevant for serial acquirers, who might be bolting on profitability at the expense of capital efficiency. While ROE has been increasing towards the groups 13% target (leverage effect), ROIC including goodwill [1] has declined in recent years back in line with the long run average. Normalising the tax rate for FY25 brings it down further to 11%.

ROIC calculated as EBIT*(1-tax rate)/(Depreciating fixed assets + working capital + non-excess cash). Goodwill reflects the amount paid for an acquisition in excess of its net assets. ↩︎

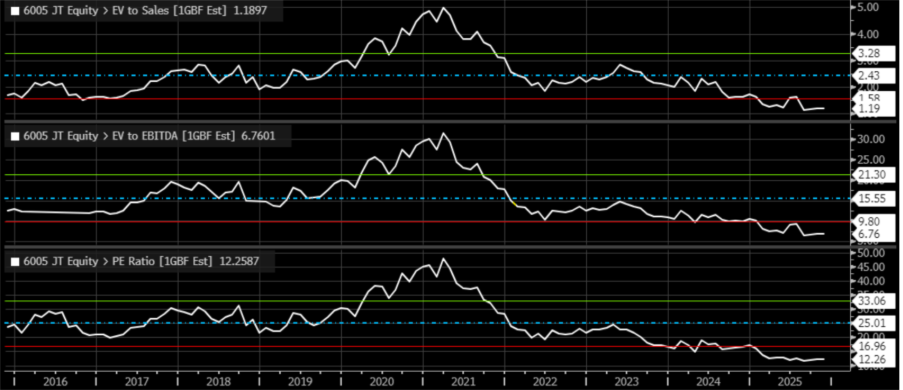

So, what will all this set you back? Shares are trading at 10-year lows across headline multiples, and peak yields. As a reference point, Miura paid 8.8x EV/EBITDA for CB and itself currently trades on 6.8x (vs 10 Yr Historic Average of ~16x). Woof. What multiple the business should trade on is, of course, up for debate. What is not, however, is that the shares currently trade on 7% FCF yield, with cash flows underpinned by 35% recurring sales and strong cash conversion [1].

Operating cash conversion has averaged 94% over the last nine years. ↩︎

The relationship between Price-Book multiple and ROE has also broken down.

Conclusions.

As I write, a confluence of powerful factors is causing financial markets to whipsaw violently. Volatility has spiked. US big tech AI champions are selling off. Private credit markets may have overreached. Liquidity is drying up (check US overnight REPO rates). The future looks more uncertain than ever. So rather than speculating on what might change, how about what is less likely to? Investing in a stable boiler business, growing ahead of GDP, throwing off cash, at an attractive valuation is less likely to keep me up at night than the latest meme-coin or triple leveraged AI-ETF. You might disagree. All a matter of opinion. Happy to compare notes.

*Please do not consider this to be financial advice. Just my observations. Do your own work.*